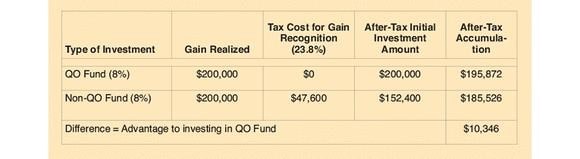

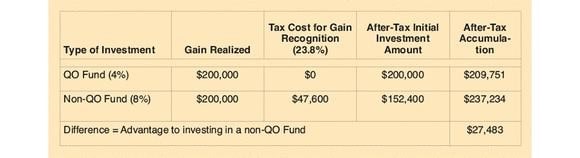

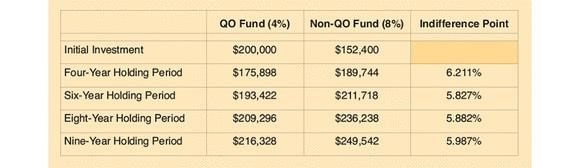

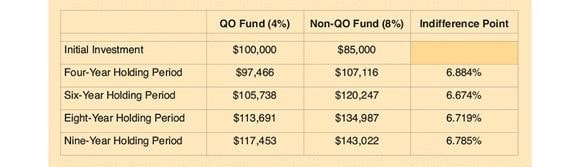

Exhibit 1. Comparison of After-Tax Accumulations with Equal Before-Tax Rates of Return, Four-Year Holding Period

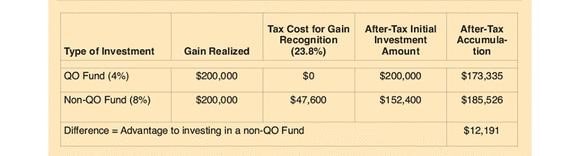

Exhibit 2. Comparison of After-Tax Accumulations with Different Before-Tax Rates of Return, Four-Year Holding Period

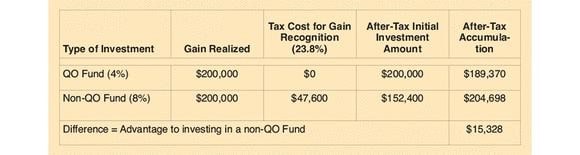

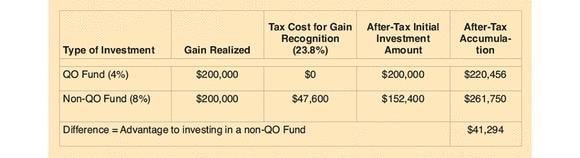

Exhibit 3. Comparison of After-Tax Accumulations with Different Before-Tax Rates of Return, Six-Year Holding Period

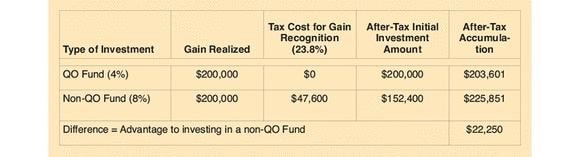

Exhibit 4. Comparison of After-Tax Accumulations with Different Before-Tax Rates of Return, Eight-Year Holding Period

Exhibit 5. Comparison of After-Tax Accumulations with Different Before-Tax Rates of Return, a Nine-Year Holding Period, and Recognition of Remaining Invested Gain

Exhibit 6. Comparison of After-Tax Accumulations with Different Before-Tax Rates of Return, an 11-Year Holding Period

Exhibit 7. Comparison of After-Tax Accumulations with Different Before-Tax Rates of Return, 29.6% Effective Marginal Tax Rate

Exhibit 8. Comparison of After-Tax Accumulations with Different Before-Tax Rates of Return, 25.6% Marginal Tax Rate, 15% Capital Gains Rate, No NII

Exhibit 9. Comparison of After-Tax Accumulations with Different Before-Tax Rates of Return, Funds Organized as C Corporations with 21% Marginal Tax Rate [13]

[13] Scholes, Wolfson, et al, Taxes and Business Strategy, Third Edition (2005), pp. 85-86, Formula for after-tax accumulation where R is the before-tax rate of return, tp is the taxpayer’s marginal tax rate, and n is the length of the investment: $1[(1+R(1-tp)]n; Ault, Kelvin, et al, “Using Qualified Opportunity Zone Investments,” State Tax Notes, 8/6/18, pp. 1-9.